QuantRocket vs QuantConnect: What Are the Differences?

QuantRocket is faster and more flexible than QuantConnect and better leverages the Python data science ecosystem.

QuantRocket and QuantConnect are competing platforms that support researching, backtesting, and trading quantitative strategies. They have many similarities but also many important differences. Find out the differences and why QuantRocket is a powerful and more flexible alternative to QuantConnect.

Jump to:

Difference #1: Programming Language

QuantRocket is a native Python framework while QuantConnect is a C# framework with a Python wrapper.

QuantRocket is written in Python and makes extensive use of Python's ecosystem of data science and machine learning libraries. QuantRocket users gain familiarity with popular open-source libraries like pandas, NumPy, Matplotlib, and scikit-learn. These libraries are the gold standard of quantitative finance and are used by most quantitative finance professionals.

QuantConnect is written in C#, a language rarely used in quantitative finance. Due to C#'s unpopularity, QuantConnect provides an auto-generated Python wrapper around the C# library. With this wrapper, you can write your code in Python syntax, but the underlying design and structure is still C#. QuantConnect's Python wrapper doesn't leverage Python's ecosystem of data science packages, so users don't learn well-known APIs or build portable skills. The Python wrapper also adds a translation step that makes code run slower.

Advantages of native Python over C#:

- Use Python tools and libraries you already know.

- Learn the same packages that other quantitative finance professionals use.

- Avoid the dead-end of learning a language that isn't widely used in the industry.

Difference #2: Hardware Performance

QuantRocket leverages the power of your existing hardware, while QuantConnect's hosted platform limits your compute power.

QuantRocket is built on Docker and can run locally on hardware you already own or in the cloud on hardware you control. Quants with powerful workstations or laptops can utilize that existing power for their research and save money on hosting costs. Alternatively, you can deploy QuantRocket to the cloud provider of your choice, including to Oracle's generous free tier (4 CPUs, 24GB of memory, 200GB of storage). Running on hardware you control offers better privacy than a hosted platform.

QuantConnect's hosted platform has hard limits on available compute power. If you need more than 16GB of memory for backtesting or 4GB for live trading, you're out of luck, because that's the most they offer.

Difference #3: Number of Backtesters

QuantRocket supports multiple backtesters, while QuantConnect only supports one.

QuantRocket offers a suite of open-source backtesting and analysis libraries with complementary strengths, allowing you to fit the right tool to the job for a wide array of trading styles and research questions.

QuantConnect only offers one backtesting engine, limiting you to strategies that conform well to its design.

| Zipline - event-driven backtester that originally powered Quantopian |

| Alphalens - alpha factor analysis library |

| Pipeline - screening tool for large universes of securities |

| Moonshot - Pandas-based backtester |

| MoonshotML - machine learning backtester with walk-forward optimization |

| Lean - event-driven C# backtester |

Difference #4: Backtest Speed

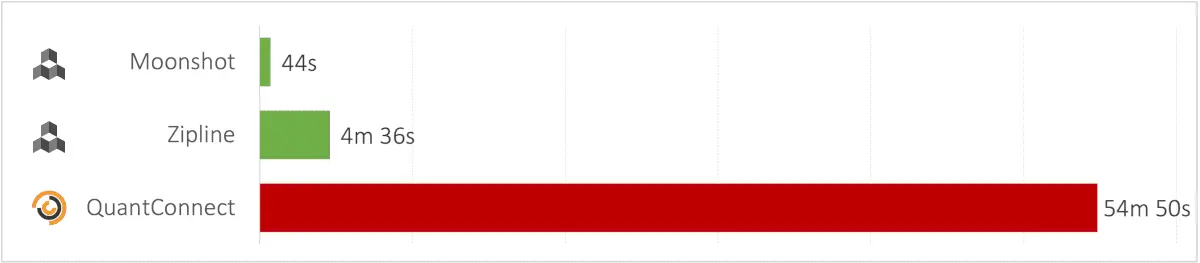

QuantRocket backtests run up to 75x faster than QuantConnect for data-intensive strategies.

QuantRocket's backtesting libraries have a significant speed advantage over QuantConnect that becomes more apparent the more securities you include in your trading universe. QuantRocket's speed advantage is mainly due to a combination of factors already mentioned: QuantRocket's ability to leverage superior hardware, and its use of highly optimized, blazing fast Python libraries like pandas and NumPy. See the full performance review.

Difference #5: Customizability

QuantRocket's open architecture makes it flexible and extensible, while QuantConnect's hosted design limits customization.

Customization can be essential to getting a platform to do what you want. QuantRocket has an open architecture that runs on Docker and uses JupyterLab as its user interface, making it extremely flexible and extensible. You can run custom scripts to collect data from an alternative data source or calculate custom indicators. You have complete access to the environment and filesystem just as you would with a custom-built system.

Hosted platforms like QuantConnect can't offer the same flexibility. QuantConnect's platform lets you type code in a web GUI and press buttons to backtest the code. If there's no button that does what you want, you're stuck.

Custom requirements often don't arise at first but only as you get deeper into your research and trading. This makes it risky to adopt a platform that doesn't support customizations.

Difference #6: Global Coverage

QuantRocket supports global equities, while QuantConnect supports US equities only.

Most traders focus on the US market, but the US market represents only 50% of global market cap and only 25% of global listings. QuantRocket allows you to trade equities around the globe, opening up profitable opportunities that traders who focus solely on the US miss.

With QuantConnect, you're limited to the US market, the most competitive market in the world.

Reasons to trade international stocks:

- Escape crowded trades: Academic research shows that market anomalies are more enduring in international markets.

- Find the right market: Write your strategy code once and backtest it in numerous countries to find where it works best.

- Validate your backtests: A backtest that performs well across several global markets is more robust than one tested on a single market.

Difference #7: Fundamental Data Quality

QuantRocket offers point-in-time fundamental data, while QuantConnect describes its fundamental data as point-in-time-"ish".

To avoid look-ahead bias in backtests, it's critical to use point-in-time data, which is data that reflects only what was known at the time, not what came to be known later.

QuantRocket's fundamental data provider, Sharadar, provides point-in-time data that is free of look-ahead bias. When companies revise their financial statements, Sharadar's timestamp reflects the date of the revision, not the original date of the statement that was revised.

QuantConnect's fundamental data provider, Morningstar, mainly serves clients focused on current research rather than historical backtesting. As a result, this provider may not be as careful to avoid introducing look-ahead bias. Here's what the founder of QuantConnect acknowledged about their fundamental data when a customer asked if it is point-in-time:

QuantConnect customers should avoid using fundamental data in their backtests unless they are able to confirm the data's precision and accuracy.

About QuantRocket

QuantRocket is a Python-based platform for researching, backtesting, and trading quantitative strategies. It provides a JupyterLab environment, offers a suite of data integrations, and supports multiple backtesters: Zipline, the open-source backtester that originally powered Quantopian; Alphalens, an alpha factor analysis library; Moonshot, a vectorized backtester based on pandas; and MoonshotML, a walk-forward machine learning backtester. Built on Docker, QuantRocket can be deployed locally or to the cloud and has an open architecture that is flexible and extensible.

Learn more or install QuantRocket now to get started.

Send a Message

Send a Message