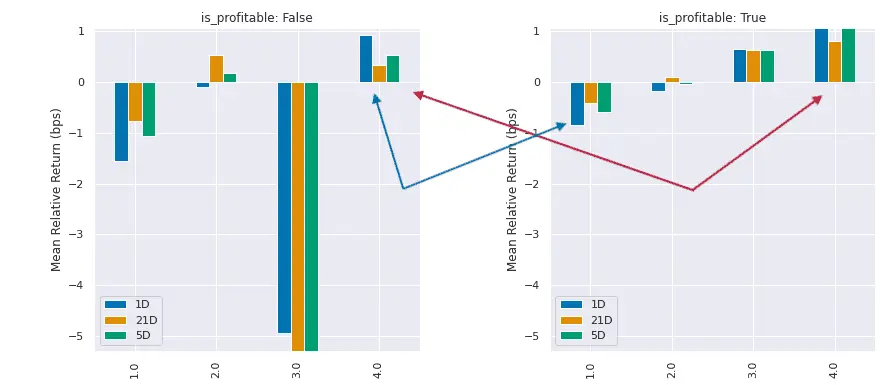

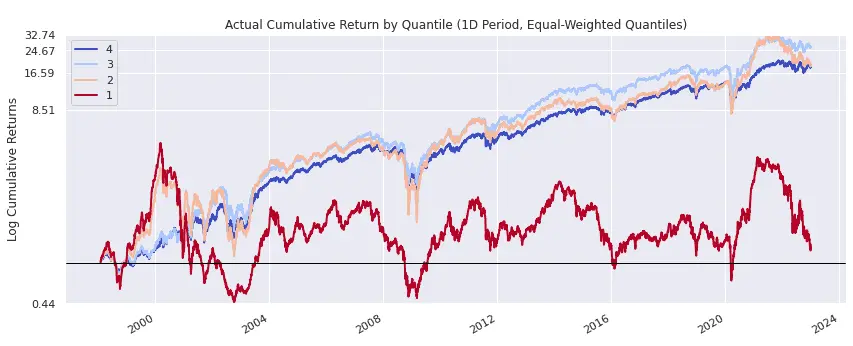

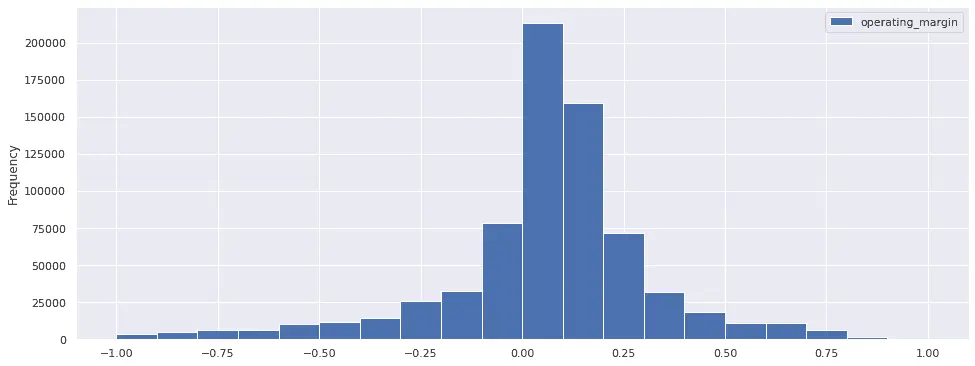

Should investors prefer companies with high profit margins or companies with improving profit margins? Is it better to own an unprofitable company that's getting better, or a profitable company that's getting worse? This post explores these questions by analyzing the profitability growth factor and how it interacts with the profitability and size factors to impact stock performance.

Send a Message

Send a Message