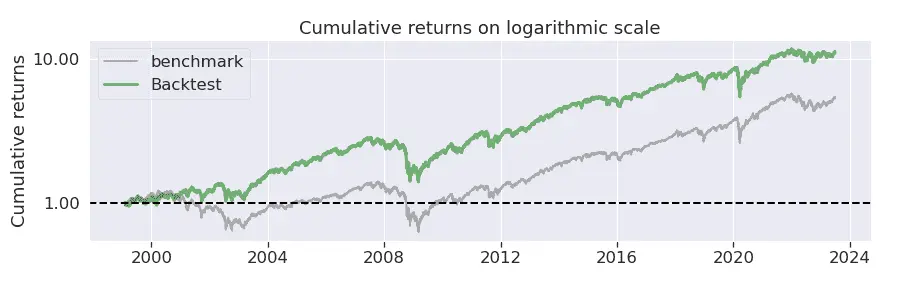

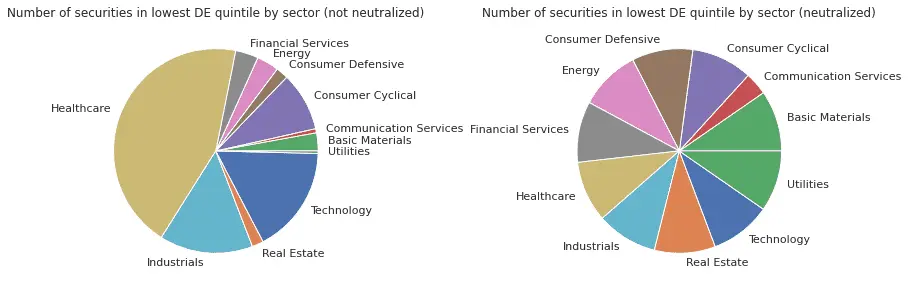

Buying high-quality stocks and avoiding low-quality ones can improve investment returns. In this post, I use Alphalens and Zipline to analyze the Piotroski F-Score, a composite measure of a firm's financial health and quality.

Buying high-quality stocks and avoiding low-quality ones can improve investment returns. In this post, I use Alphalens and Zipline to analyze the Piotroski F-Score, a composite measure of a firm's financial health and quality.

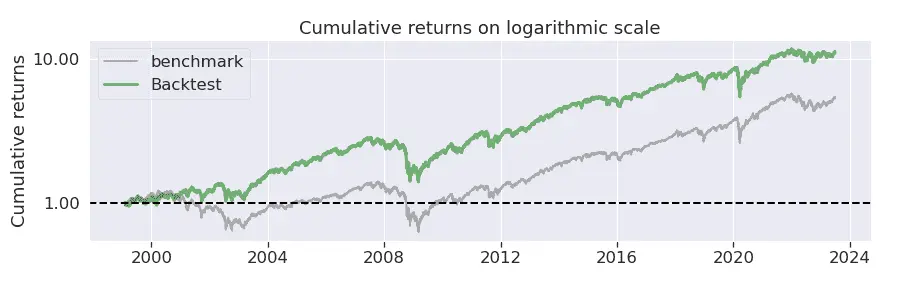

Are rising interest rates straining balance sheets and increasing the risk of bankruptcies? This article investigates two financial distress factors, the Altman Z-Score and interest coverage ratio, to see if distress is on the rise and how it impacts stock returns.

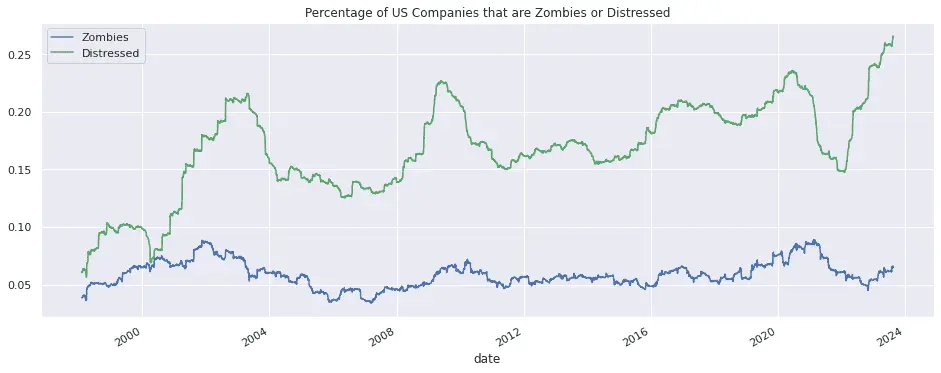

Sector neutralization is a technique to hedge out sector bets and reduce the impact of sector-specific risks on the portfolio by ranking factors within sectors rather than across sectors. This post uses the debt-to-equity ratio to show why sector neutralization is important and how to perform it in Pipeline.

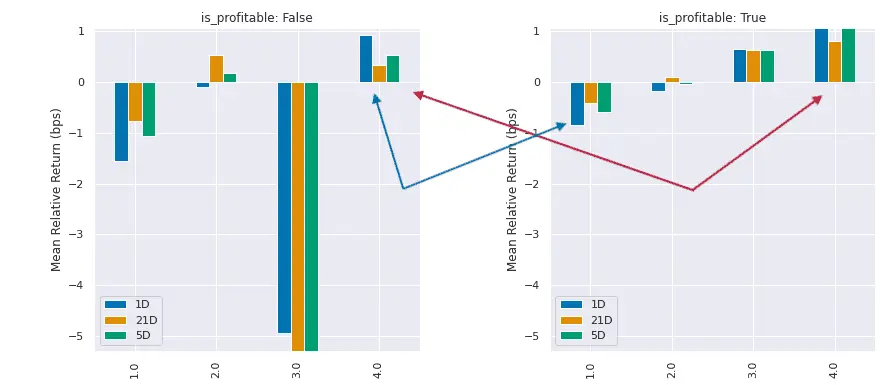

Should investors prefer companies with high profit margins or companies with improving profit margins? Is it better to own an unprofitable company that's getting better, or a profitable company that's getting worse? This post explores these questions by analyzing the profitability growth factor and how it interacts with the profitability and size factors to impact stock performance.

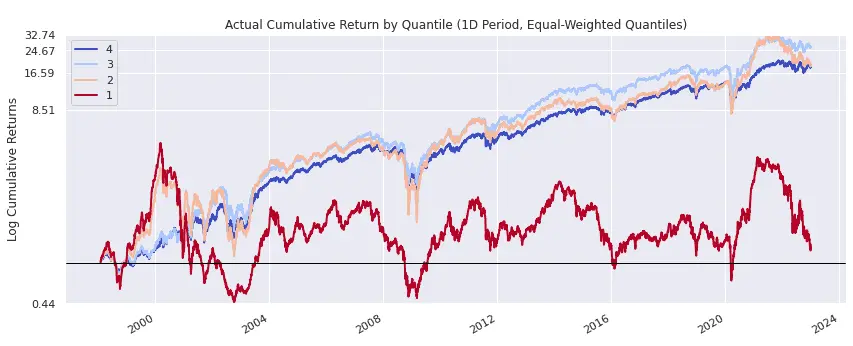

How does a company's profitability affect its stock returns? In this post, I use Alphalens, a Python library for analyzing alpha factors, to investigate the relationship between operating margin, a profitability ratio, and future returns.

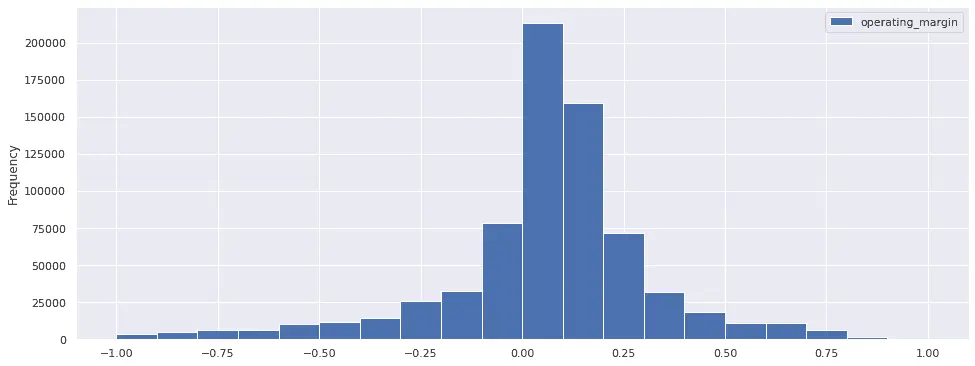

When researching fundamental factors, analyzing alpha shouldn't be your first step. You can save time and spot issues early by starting with a basic exploration of your factor's distribution and statistical properties, a process known as exploratory data analysis (EDA). This post looks at operating margin, a profitability ratio, to demonstrate what you can learn from exploratory data analysis.